Handling money can be a very difficult task, especially given the many cases of debit and credit card fraud that come to light each year. Thankfully, banks and credit unions are providing new services to address these issues, such as smartphone apps that allow members to maintain complete control of their cards, no matter where they happen to be. This is especially useful in case somebody were to accidentally lose their debit or credit cards, as this would give them less hoops to jump through in order to freeze their accounts due to such a situation. However, prevention is still better than cure.

In this article, we will discuss a few ways that you and your employees can protect themselves from identity and bank fraud.

Be Wary of Smishing Attempts

This is when somebody sends you a text message claiming to be an official representative from your financial institution of choice. They will inform you that your account has been breached, and will instruct you to call a specific number in order to resolve the issue. Then, the other person on the line will ask for your account number and PIN, which basically gives them access into your bank account.

When in doubt, call up the official numbers listed on your bank or credit union’s webpage or letterhead, and confirm whether or not the breach actually occurred.

Stay Away from Shared Computers

If you share a single computer with other people, whether it is located in your home, school, or office, then you increase your chances of having your account compromised. You also expose yourself to malware, especially if the units are not properly maintained. Left undetected, malware could record your every movement, giving hackers the information that they need to break into your account.

If you do not have your own computer or just really need to carry out a transaction for an emergency situation, make absolutely sure that you log out of your account and clear the computer’s browser history and cookies.

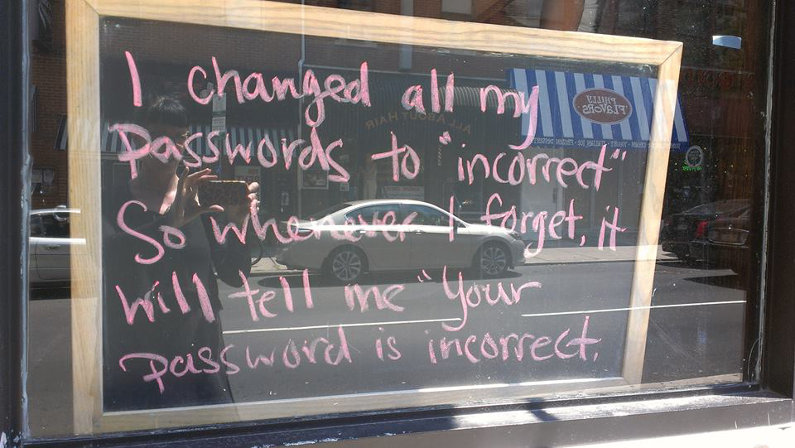

Use a Super Strong Password

Even if you do all of the above, it will be all for naught if your password is something that is way too easy to guess. Make sure to use up the maximum number of characters allowed, as longer character lengths make it harder for hackers to crack your password.

If you find it hard to think of difficult passwords that you can memorize, try looking into password management apps that can automatically generate new ones for each new account that you make. You won’t even have to type it out, as it can fill in your credentials for you with just a single click.

The Takeaway: Always Think Twice

Before you give away your personal information or click on any button, always take a few seconds to pause and think about your actions. Even if it may take up more of your time, always prioritize being safe than sorry, and confirm any suspicions that you have with your bank or credit union.